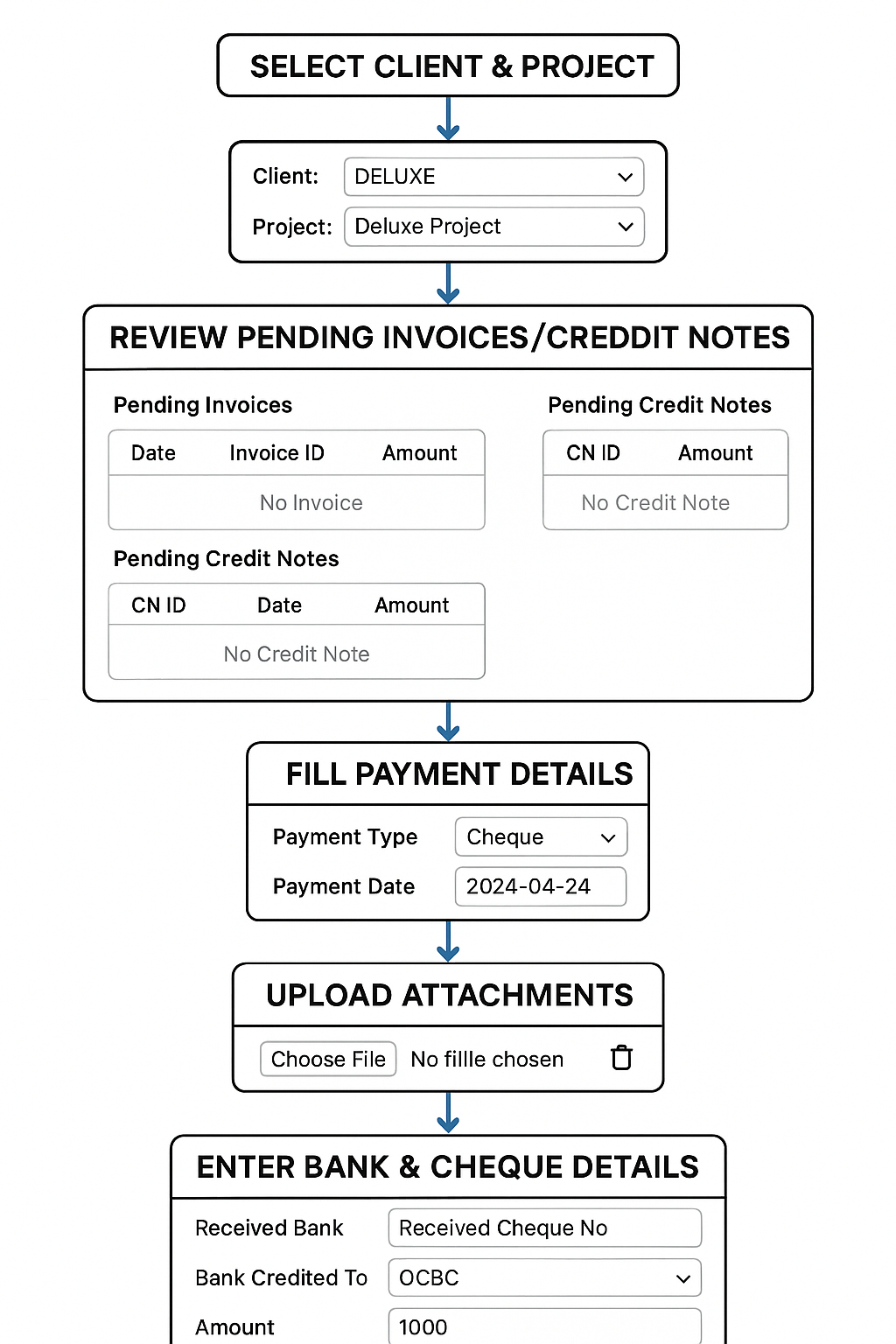

Payment Flow Explanation:

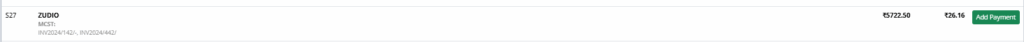

Click on Add payment

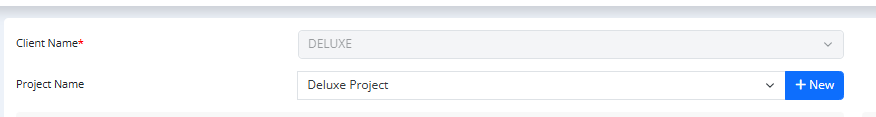

Client and Project Selection

- At the top, you first select the Client Name from the dropdown list (example shown: DELUXE).

- Then, select the associated Project Name (example shown: Deluxe Project).

- There is an option to create a new project if needed by clicking the + New button.

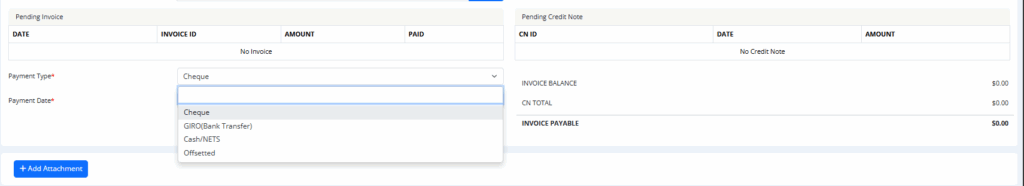

- Pending Invoices and Credit Notes

- Pending Invoice Section: Displays any invoices that are unpaid for the selected client and project.

- Columns include Date, Invoice ID, Amount, and Paid Status.

- In the image, it shows “No Invoice,” meaning no pending invoices exist.

- Pending Credit Note Section: Lists any pending credit notes for the client.

- Columns include CN ID (Credit Note ID), Date, and Amount.

- In this case, it shows “No Credit Note.”

- Pending Invoice Section: Displays any invoices that are unpaid for the selected client and project.

- Payment Details

- Payment Type: Choose how the payment is made (e.g., Cheque, Cash, Bank Transfer).

- Payment Date: Select the date the payment is received.

- Attachments

- There is an option to Add Attachments like scanned cheques, bank slips, or payment proofs.

- Files can be uploaded through the “Choose File” button.

- A delete (trash bin) icon allows removal of attachments if needed.

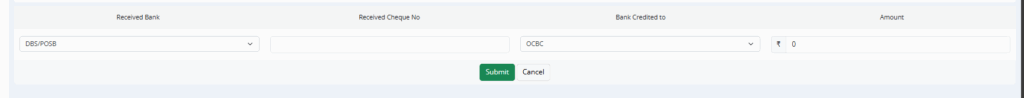

- Bank and Cheque Information

- Received Bank: Select the bank into which the payment was received.

- Received Cheque No: Enter the cheque number (if payment is by cheque).

- Bank Credited To: Choose the bank account where the payment is credited (e.g., OCBC).

- Amount: Enter the payment amount received.

- Final Actions

- After filling in all details, you have two options:

- Submit the payment to finalize and record it.

- Cancel if you wish to discard or reset the information entered.

- After filling in all details, you have two options:

Summary of Flow:

Select Client & Project → Review Pending Invoices/Credit Notes → Fill Payment Details → Upload Attachments → Enter Bank & Cheque Details → Submit

Notes:

- The system helps you track outstanding invoices and credit notes linked to each client/project.

- It ensures that received payments are properly documented against the correct bank accounts.

- Allows smooth handling of cheque payments with attachment upload for proof.

- Keeps a clean audit trail with all recorded payments.