Process for Creating a New Invoice:

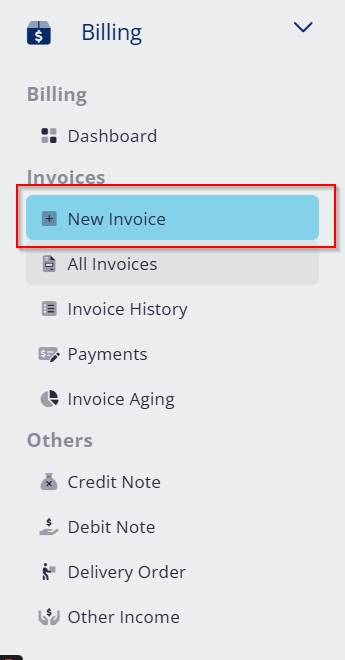

- Creation of a New Invoice

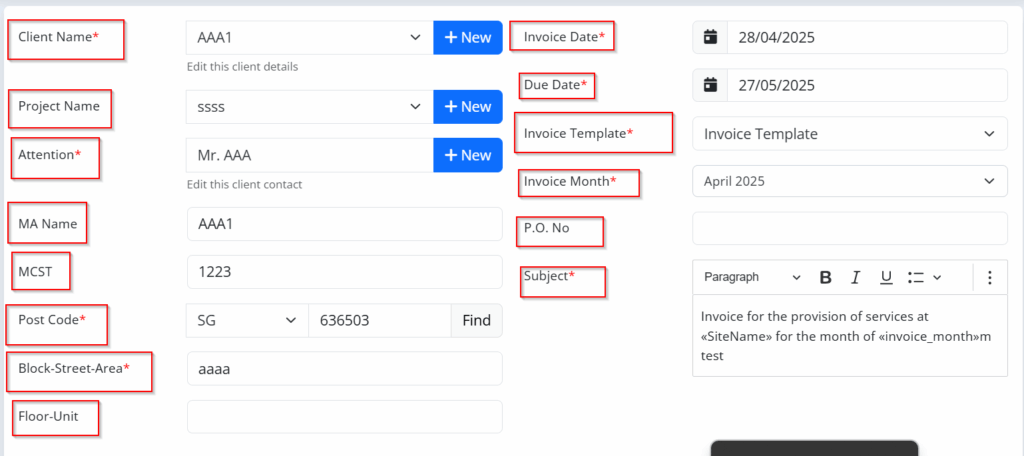

Begin by initiating the creation of a new invoice in the accounting or invoicing system. - Client and Project Information

- Enter the client name and project name accurately.

- Add the attention person (the individual at the client’s side who is responsible for handling the invoice).

- Include additional important details like the Managing Agent (MA) name, the MCST number (if applicable), and the postal code.

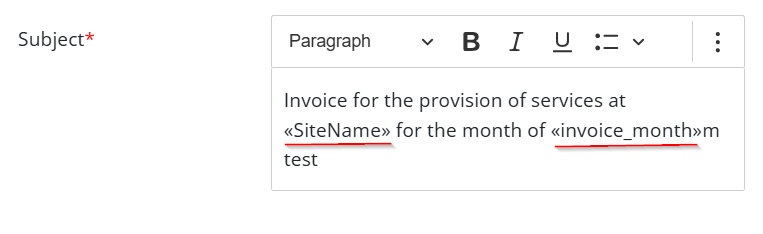

- Invoice Subject

- Insert the invoice subject in the provided field.

- The subject should follow this format:

“Invoice for the provision of security services at «SiteName» for the month of «invoice_month».”

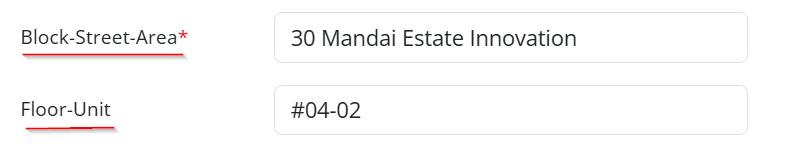

- Site Address Details

- Record the block number and street/area name.

- Enter the floor and unit number where services were provided.

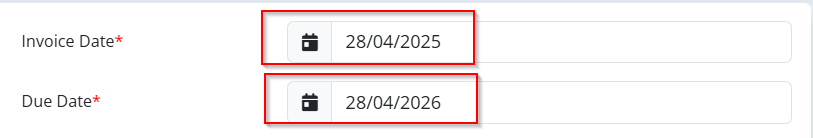

- Invoice and Due Dates

- Set the invoice date (the date the invoice is issued).

- Insert the due date (the deadline by which payment must be made).

- Invoice Template Details

- Fill in the Purchase Order (P.O.) number if applicable.

- Confirm that the invoice subject matches the one inserted earlier.

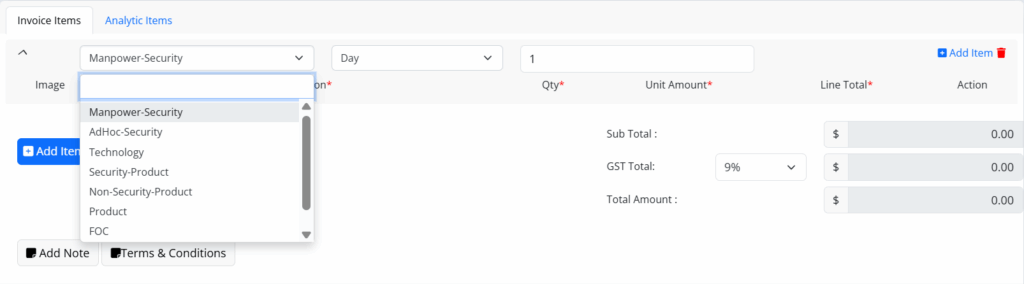

- Invoice Items Entry

- Add all service and product items under their correct categories:

- Manpower Security

- Ad-hoc Security

- Technology Services

- Security Products

- Non-Security Products

- Products (general)

- FOC (Free of Charge items)

- Installation & Maintenance Services

- Make sure to add the appropriate maintenance group under Installation & Maintenance when needed.

- Add all service and product items under their correct categories:

- Discount Application

- If there are any discounts applicable, add them clearly at the appropriate section.

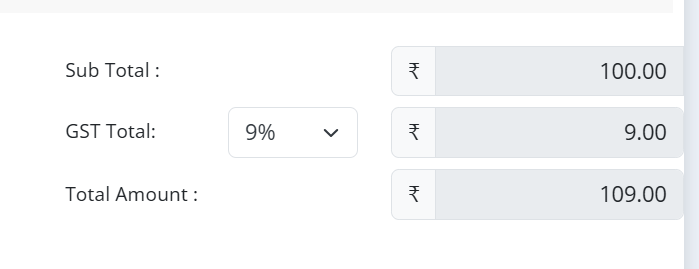

- Subtotal and Tax Calculation

- Enter the subtotal amount — the total before any taxes are added.

- Input the GST (Goods and Services Tax) percentage.

- The system should automatically calculate the GST total based on the subtotal.

- Total Invoice Amount

- The system will automatically calculate the final total amount (Subtotal + GST – Discounts).

- Review Before Submission

- Double-check all the entered information, ensuring it is accurate, matches contractual terms, and the calculation is correct before issuing the invoice to the client.