Debit Note Workflow Explanation:

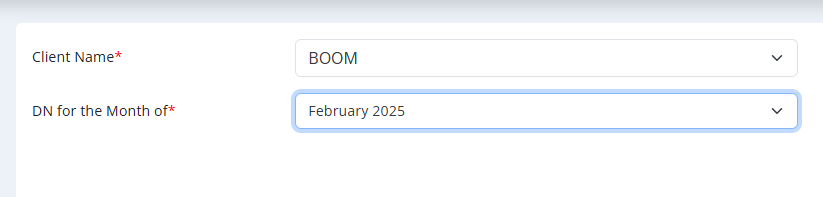

- Select Client and Month

- Client Name: Select the client to whom the debit note will be issued (example: KING’S MANSION).

- DN for the Month of: Choose the month for which the debit note is being raised (example: January 2025).

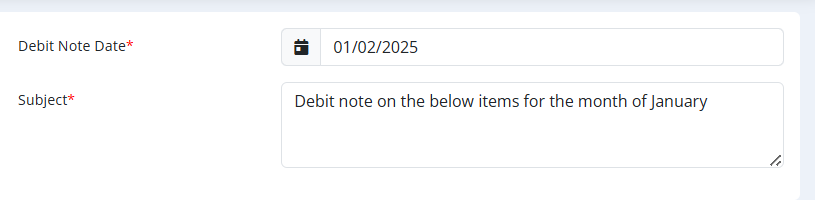

- Enter Debit Note Details

- Debit Note Date: Choose the date when the debit note is being created (example: 01/02/2025).

- Subject: Provide a brief description or subject for the debit note (example: Debit note on the below items for the month of January).

- Add Debit Note Items

- Under Debit Note Items section:

- Description: Mention the details of the item or service being debited.

- Amount: Enter the amount being charged for that line item.

- Add Line Item: Allows you to add multiple items if the debit note includes several charges.

- Each line item can be deleted using the red trash bin button.

- Under Debit Note Items section:

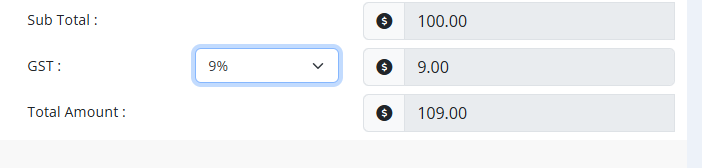

- Automatic Amount Calculation

- Sub Total: Automatically calculates the total of all line items before tax.

- GST: Select the applicable Goods and Services Tax (GST) percentage.

- Total Amount: Automatically computes the final total after applying GST.

- Final Actions

- After verifying all details:

- Click Submit to finalize and create the Debit Note.

- Click Cancel to abort the operation if needed.

- After verifying all details:

Summary of Workflow:

Select Client & Month → Fill Debit Note Details → Add Items & Amounts → Automatic Totals → Submit or Cancel

Purpose of Debit Note Module:

- Increase the receivables from the client when additional charges need to be billed.

- Used when there were underbillings, additional work, or missed charges on the original invoice.

- Ensures transparent adjustments between the company and the client.