Credit Note Workflow Explanation:

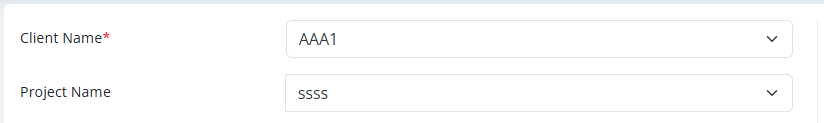

- Select Client and Project

- Client Name: Choose the client (example shown: AAA1).

- Project Name: Select the relevant project linked to the client (example shown: ssss).

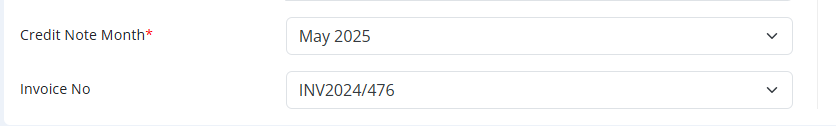

- Enter Credit Note Details

- Credit Note Month: Choose the month to which the credit note relates (example: May 2025).

- Invoice No: Select or enter the original invoice number against which this credit note is being issued (example: INV2024/476).

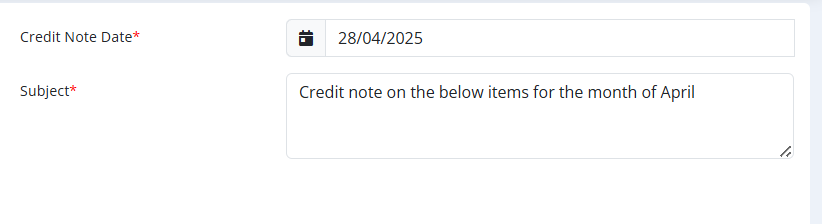

- Set Credit Note Date and Subject

- Credit Note Date: Pick the date when the credit note is created (example: 28/04/2025).

- Subject: Provide a clear subject for the credit note (example given: Credit note on the below items for the month of April).

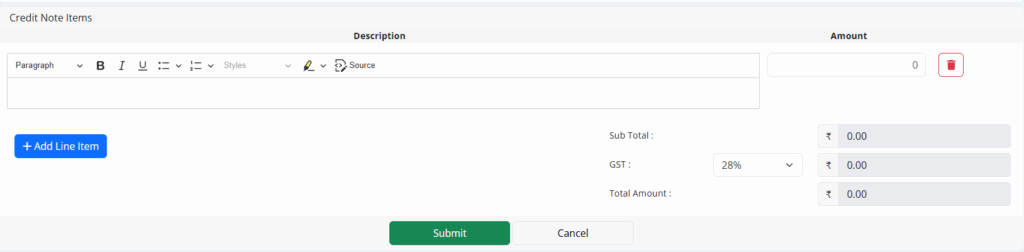

- Add Credit Note Items

- Under Credit Note Items section:

- Description: Provide a detailed description of the item/service for which the credit is being given.

- Amount: Enter the credited amount for that line item.

- You can add multiple line items by clicking the + Add Line Item button.

- Each line item can also be deleted using the red trash bin icon.

- Under Credit Note Items section:

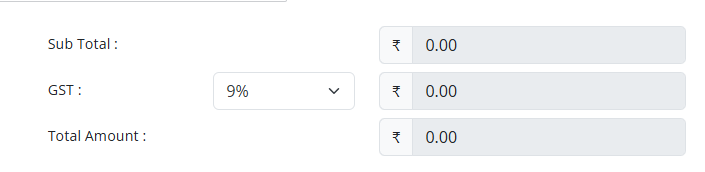

- Automatic Calculation of Amounts

- Sub Total: Automatically sums up the total amount before GST.

- GST: Select applicable GST rate from the dropdown (example shown: 9%).

- Total Amount: Automatically calculates the final amount after adding GST to the subtotal.

- Final Actions

- Once all fields are filled in:

- Click Submit to save the Credit Note.

- Click Cancel if you want to discard or reset the credit note entry.

Summary of Workflow:

Select Client & Project → Enter Credit Note Details → Add Items & Amounts → System Calculates Total → Submit or Cancel

Purpose of Credit Note Module:

- Helps correct overbilling or cancel invoice amounts.

- Maintains proper records linked to original invoices.

- Ensures transparent adjustment between clients and internal accounting.